Book value per share formula

Book value per share is determined by dividing common shareholders equity by total number of outstanding shares. One of the greatest marvels of the marine world the Belize Barrier Reef runs 190 miles along the Central American countrys Caribbean coast.

Graham S Magic Multiple Gmm Is A Formula That Measures A Stock S Fundamental Value By Taking The Company S Earnings Pe Investing Book Value Christmas Bulbs

Essentially this tells a potential investor what claim on the Book Value of a.

. For example if a company has Book Value of 100mm and currently has 50 million shares outstanding BV Share is 100000000 50000000 20. Total Outstanding Shares Total Number of Shares Issued Shares as Treasury Stock. 5 Accredited Valuation Methods and PDF Report.

Now lets input the solved values into the Price to book value ratio equation. To find the equity you should subtract the companys liabilities. The term book value is a companys assets minus its liabilities and is sometimes referred to as stockholders equity owners equity shareholders equity or simply equity.

Current share price 25. The formula for BVPS is. TBVPS determines the potential value per share of a company in the event.

Its part of the larger Mesoamerican Barrier Reef System that stretches from Mexicos Yucatan Peninsula to Honduras and is the second-largest reef in the world behind the Great Barrier Reef in Australia. So the result here is 100 which means the company actually has the equity of value 100 each. BVPS frac text Total Equity - text.

Book value per share Total equity Preferred shares Average of outstanding ordinary shares From the equation above this metric only measures the value of ordinary shares. Book Value Per Share Shareholders Equity Preferred Equity Weighted Average of Common Shares Outstanding. The book value per share formula is used to calculate the per share value of a company based on its equity available to common shareholders.

So you have to deduct the total shareholder equity with preferred shares. It is a metric that is mostly used by value investors people like Warren Buffet. Ad Trade SP 500 Index options with a 100 multiplier SPX or a 10 multiplier XSP.

Lets calculate the book value per share using the formula. Tangible book value per share TBVPS is the value of a companys tangible assets divided by its current outstanding shares. In other words the company has 2000 equities each of which is valued at Rs100.

Ad No Financial Knowledge Required. Thus the formula is as given below. Book Value per share Total common shareholders equity Number of common shares.

Reliable Valuation -Based on Market Data- to Increase the Success of Your Deal. Total equity preferred equity and total outstanding. BVPS frac Total Shareholder Equity - Preferred Equity Total Outstanding.

A stock trading. Book Value Per Share Formula The formula for determining book value per share or BVPS is. Value investors always look for discounts and so make use of the BVPS as a useful tool to purchase a stock at a real value.

To calculate the book value per share the assets of the company are totalled. Book Value per Share. Book Value Per Share BV Share is a financial ratio used to assess the amount of Book Value which 1 share of the company will give you exposure to.

Book valuenumber of shares outstanding 1 billion book value 100 million outstanding shares ie The book value per share 10. Total Number of Outstanding Shares. The importance of book value per share formula and calculation is that it serves as an essential tool for value investors.

Here is the workout. BVPS Book Value Number of Shares Outstanding A company that has a book value of 100 million and 25. The formula for book value per share requires three variables.

All the liabilities debt as well as the liquidation price of the preferred stock are subtracted and the resultant figure is to be divided by the common stocks outstanding shares. The formula for the book value per share involves taking the book value of equity and dividing that figure by the weighted average of shares outstanding. If book value is negative where a companys liabilities exceed its assets this is known as a balance sheet insolvency.

Conclusion The book value per share is the minimum cash value of a company and its equity for common shareholders. Shareholders Equity Preferred Shares. Book Value Per Share10.

The book value per common share formula below is an accounting measure based on historical transactions. Book value per share 200000 2000.

Intrinsic Value Calculator And Guide Discoverci Intrinsic Value Value Investing Stock Analysis

Financial Management Formulas Part 1 Business Strategy Management Financial Management Financial Accounting

P B Ratio Financial Statement Analysis Fundamental Analysis Financial Ratio

Functions And Limits Basic Definition And Formulas Mathematics Xii Mathematics Math Formulas English Writing Skills

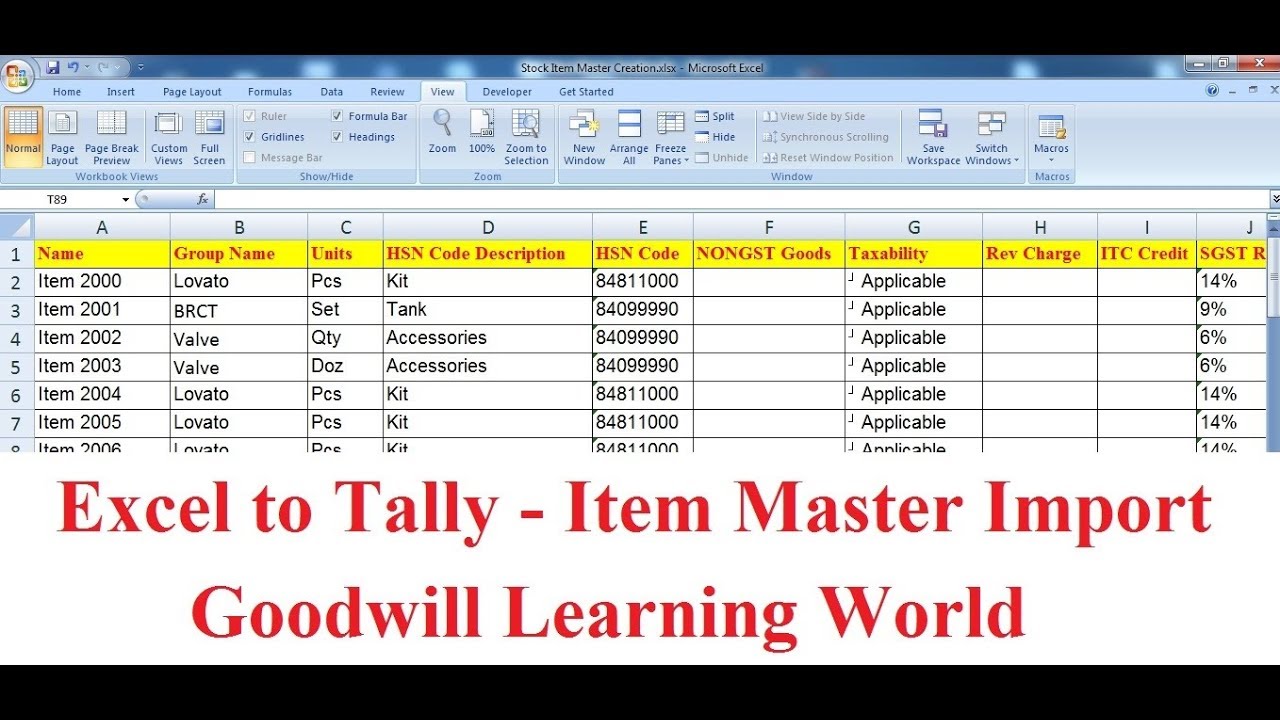

Tally Tdl For Excel To Tally Stock Item Master Import With Group And Excel The Unit Master

How To Calculate Total Paid In Capital Accounting And Finance Accounting Books Financial Management

The Simplest And Most Commonly Used Method Straight Line Depreciation Is Calculated By Taking The Purchase Or Acquisitio Business Valuation Method Subtraction

Perpetuity In 2022 Economics Lessons Accounting And Finance Finance

The Book Value Per Share Formula Is Used To Calculate The Per Share Value Of A Company Based On Its Equity Available To Co Book Value Business Valuation Shared

Definition Of An Introduction To Compound Interest Chegg Com Compound Interest Simple Interest Life Application

Cpa4ouf4 Fko9m

Common Financial Accounting Ratios Formulas Financial Analysis Accounting Small Business Resources

Stock Analyst Report Template 4 Professional Templates Marketing Report Template Report Template Marketing Report

Trading News Option Trading Stock Trading Strategies Stock Options Trading

Money Management To Trade Forex Get The Free Download Ebook Click The Link Or Visit Website Www Pipsumo Com Money Management How To Raise Money Money Skills

Business Valuation Veristrat Infographic Business Valuation Business Infographic

International Financial Reporting Standards Ifrs Accounting Books Accounting International Accounting